“What’s in a name? That which we call a rose by any other name would smell as sweet,” Juliet famously observed in Shakespeare’s Romeo and Juliet.

More than 400 years later, Fujifilm’s Life Sciences Group is renaming two of its companies, in a rebranding intended to position parent company Fujifilm as a strategic partner to drug and vaccine developers across the development life cycle.

Fujifilm’s contract development and manufacturing organization (CDMO) has cut the word “Diosynth” from its name, now calling itself Fujifilm Biotechnologies—while Fujifilm Irvine Scientific, a provider of products and services from discovery research through large-scale production, is now known as Fujifilm Biosciences.

“In a lot of ways, our rebranding reflects the breadth of today and the aspiration of where we’re going in the future as we work with customers across a variety of modalities,” Brandon Pence, president and chief operating officer of Fujifilm Biosciences, told GEN Edge. “We have the 55-year history of supplying cell culture media into this space. But beyond that, we’ve grown into prominent growth factors and cytokines and specialty chemicals and reagents that are used from drug discovery all the way through commercialization.”

Established in 1970, Fujifilm Biosciences offers discovery and research reagents, recombinant growth factors and proteins, specialty chemicals, and critical assay materials in addition to its cell culture media and supplements solutions in the U.S. The new brand name took effect immediately, with its legal entity name set to change effective January 1, 2026.

Fujifilm Biotechnologies is the rebranded Fujifilm Diosynth Biotechnologies, whose legal name will not change. The company was formed in 2011 when Merck & Co. sold to Fujifilm its Merck BioManufacturing Network consisting of two companies it acquired earlier, Avecia Biologics and Diosynth Biotechnology. Three years later in 2014, Fujifilm Diosynth acquired Kalon Biotherapeutic Technologies in College Station, TX, which gave the buyer expanded capacity for its growing vaccine capabilities.

In College Station, Fujifilm Biotechnologies is carrying out a 138,000-square-foot expansion of its facility designed to facilitate the manufacturing of gene therapies and vaccines. Last month, the College Station City Council and the Brazos County (TX) Commissioners Court agreed to give the company three more years, until 2028, to finish the project—whose value has been raised from $300 million to $330 million.

The city and county agreed to give the company nearly $4.9 million in additional incentive payments while Fujifilm Biotechnologies agreed to add 150 jobs with an average annual salary of $80,000 to its current College Station workforce of approximately 600.

Two companies, one strategy

Added Lars Petersen, Fujifilm Biotechnologies president and CEO: “We’re still separate companies, but we now follow the same strategy: What is it that we can offer as a company for the industry? We help each other: We have a cell culture media business, we have a manufacturing business and a development business, and we also have an IPS [induced pluripotent stem] cell business in medicine. We’re bringing all that together under one roof with one vision.”

“We definitely for the first time are defining one life science strategy and where to go with it,” Petersen added.

The companies foresee increased opportunities for collaboration, Petersen and Pence added—though Fujifilm Biotechnologies and Fujifilm Biosciences will remain separate companies within the Life Sciences Group, which promises to work with customers as “Partners for Life.”

“The investments that we’re making strategically have been in flight for years. You’re seeing them manifest now to where we’re able to be in a position well to accommodate a variety of different directions that may occur,” Pence said. “Whatever disruptions that may happen, whether they be things like the pandemic or different geopolitical changes, because of the investment strategy that Fujifilm has taken, we’re well positioned to support in the geographies that are requiring that support.”

Leadership commitment

Fujifilm Biotechnologies has committed to become a leader among CDMOs. The company ranked eighth in revenue among the Top 10 Contract Development and Manufacturing Organizations ranked by GEN in its most recent A-List published last August (an updated edition is scheduled for publication this fall), with Lonza Group topping the list and Thermo Fisher Scientific ranking second.

At present, Fujifilm Biotechnologies is completing the first phase of a $3.2 billion end-to-end biomanufacturing facility in Holly Springs, North Carolina. The company initially committed $2 billion to a facility consisting of eight 20,000 L mammalian cell culture bioreactors, then last year announced plans to invest an additional $1.2 billion by building eight additional 20,000 L bioreactors at the site by 2028.

“We can double that one more time and we can do that very rapidly, in a faster timeline than most other people would be able to do, because we simply are set up for that,” Petersen said, adding that whether Fujifilm Biotechnologies pursues that additional facility growth will depend on market demand.

Some 500 people work at Holly Springs now—a number set to rise to 700 by the end of this year, and double from there to 1,400 by 2031.

How much does the current expansion, and consideration of even further expansion, reflect efforts by the U.S. government to promote reshoring of drug production by American biopharmas?

“I would say in general, the market is growing very heavily. What happens, of course, when there’s discussions like tariffs or any other supply chain disruptions, people get nervous. So we see higher interest in general because people want to make their decision earlier than they’ve done rather than later, simply for securing their supply chains,” Petersen replied.

“Is it directly a reflection of the tariffs discussion? It has definitely increased the interest for us,” he added.

Fujifilm Biotechnologies is also in expansion mode outside the U.S. In January, the company celebrated the opening of a DKK 11 billion ($1.73 billion) expansion of its Hillerød, Denmark facility. The project has transformed the facility into the largest end-to-end CDMO in Europe by increasing the site’s capacity from six to 12 bioreactors for mammalian cell culture. The Hillerød workforce stood at 1,800 earlier this year and will grow to 2,200 jobs when the expansion is fully operational next year.

Growing CDMO revenue

Fujifilm Biotechnologies is within parent Fujifilm’s “Bio CDMO” business, which finished Fiscal Year 2024—the 12 months ending March 31—with revenue of ¥219.5 billion ($1.5 billion), up 7.9% or ¥16.1 billion ($110.4 million) from ¥203.4 billion (about $1.4 billion) in FY 2023.

The increase reflected both sales generated by new large-scale facilities—namely an expansion of the first phase at the Denmark site launched in November 2024—as well as higher pass-through adjustments for raw material costs charged to customers. Bio CDMO also benefited from the 10-year, over $3 billion contract agreement it announced in April with Regeneron Pharmaceuticals for the manufacturing of antibody drugs at Holly Springs.

Regeneron is one of two disclosed customers that will be manufacturing treatments at the first phase of the Holly Springs facility. The other is Janssen Supply Group, a Johnson & Johnson subsidiary that has committed to a large-scale manufacturing suite. No customers have been announced for the second phase of the facility, though “many discussions are going on,” Petersen said.

Fujifilm Biosciences is within Fujifilm’s “Life Sciences Solutions” business, which saw its revenues fall 2% or ¥2.3 billion (about $15.8 million) year-over-year during FY 2024, to ¥109.8 billion (nearly $752.4 million) from ¥112.1 billion (about $768 million) in FY 2023.

Among factors cited in Life Sciences Solutions’ decline this past fiscal year were the absence of the previous year’s licensing income from BlueRock Therapeutics for an eye disease treatment program, and the cost of divesting its Medical Media Business Unit (MBU) focused on in vitro fertilization and cytogenetics products to Astorg, a pan-European private equity firm focused on global healthcare investments. The divestiture was completed last month.

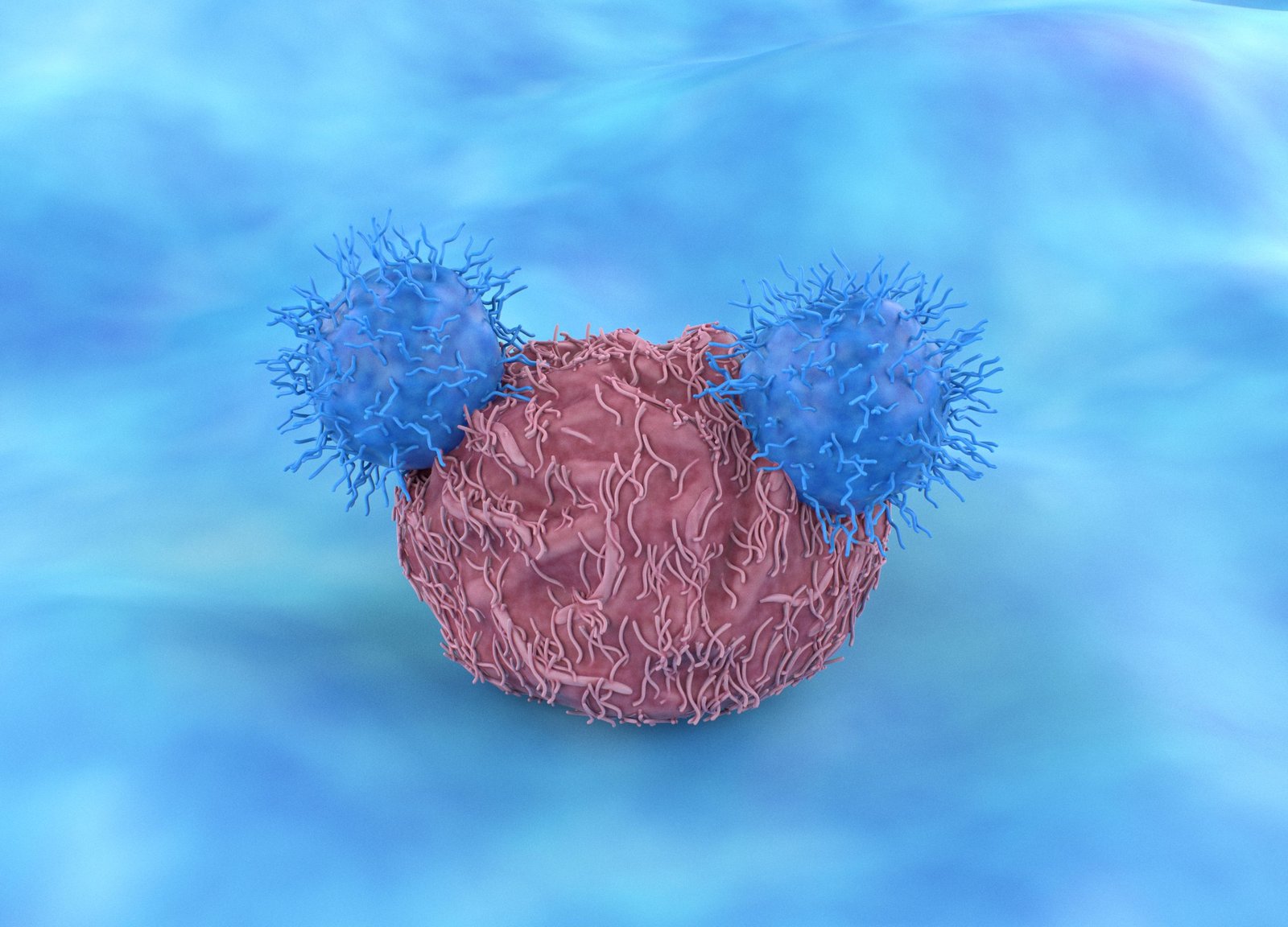

However, Solutions contained the decline with an upturn in demand for culture media. And in January, Terumo Blood and Cell Technologies (Terumo BCT) inked a collaboration with Fujifilm Irvine Scientific aimed at accelerating T cell expansion.

Shortly before the rebranding in May, Fujifilm Irvine Scientific launched a strategic collaboration of undisclosed value with Swedish cell therapy developer NextCell Pharma, whose lead candidate ProTrans is a treatment for type I diabetes now in Phase II trials. The companies agreed to provide cell therapy researchers and developers with an integrated offering that combines standardized mesenchymal stem cell (MSC) products, optimized culture media, and cryopreservation solutions.

NextCell agreed to offer its research-use-only umbilical cord MSC product with the PRIME-XV MSC media and cryopreservation product lines of what is now Fujifilm Biosciences.

Longer-term perspective

“We’re looking at this from a longer-term perspective. Our strategies are not reactive in nature. But because we’re executing on them, we’re able to respond proactively to our customers when they need us to,” Pence added.

In addition to Fujifilm Biotechnologies and Fujifilm Biosciences, the Life Sciences Group includes:

- Fujifilm Cellular Dynamics, a developer and manufacturer of human IPS cells used in drug discovery, toxicity testing, stem cell banking, and cell therapy development.

- Fujifilm Wako Pure Chemical, a provider of raw materials and intermediates used for pharmaceutical products such as laboratory chemicals, specialty chemicals and diagnostic reagents—and other products that include semiconductors, daily necessities, and cosmetics. Last year commercial operations for the company’s lab automation, lab chemicals and LAL endotoxin detection products were shifted to what is now Fujifilm Biosciences.

- Fujifilm Toyama Chemical, the only company capable of manufacturing sterile penicillin antibiotics products in Japan. The company also provides CDMO services from design to process development and GMP production of formulations using lipid nanoparticles and liposomes.

The post End-to-End: Fujifilm Rebrands Life Sciences Companies, Positioning Itself as Drug Development Cycle Leader appeared first on GEN – Genetic Engineering and Biotechnology News.