Waters plans to combine with the Biosciences & Diagnostic Solutions business of BD (Becton, Dickinson & Co.), the companies said, in a $17.5 billion deal that would be the year’s largest within life sciences, let alone among tools companies.

The companies say the deal will leave Waters better able to reach multiple high-growth end-markets by growing its high-volume testing business with offerings that include liquid chromatography, mass spectrometry, flow cytometry, and diagnostic solutions designed to be best-in-class. Value creation will stretch across bioseparations, bioanalytical characterization, and multiplex diagnostics, according to BD and Waters.

Waters has projected that the combined company would double its total addressable market (TAM) to approximately $40 billion, with more than 70% of the revenue expected to recur annually. Over half of the Waters-BD combination’s instrument revenue is expected to recur within a typical five- to ten-year replacement cycle, the companies said, with Waters planning to grow not only through instrument replacement, but via service plan attachment, e-commerce adoption, and new product launches as well.

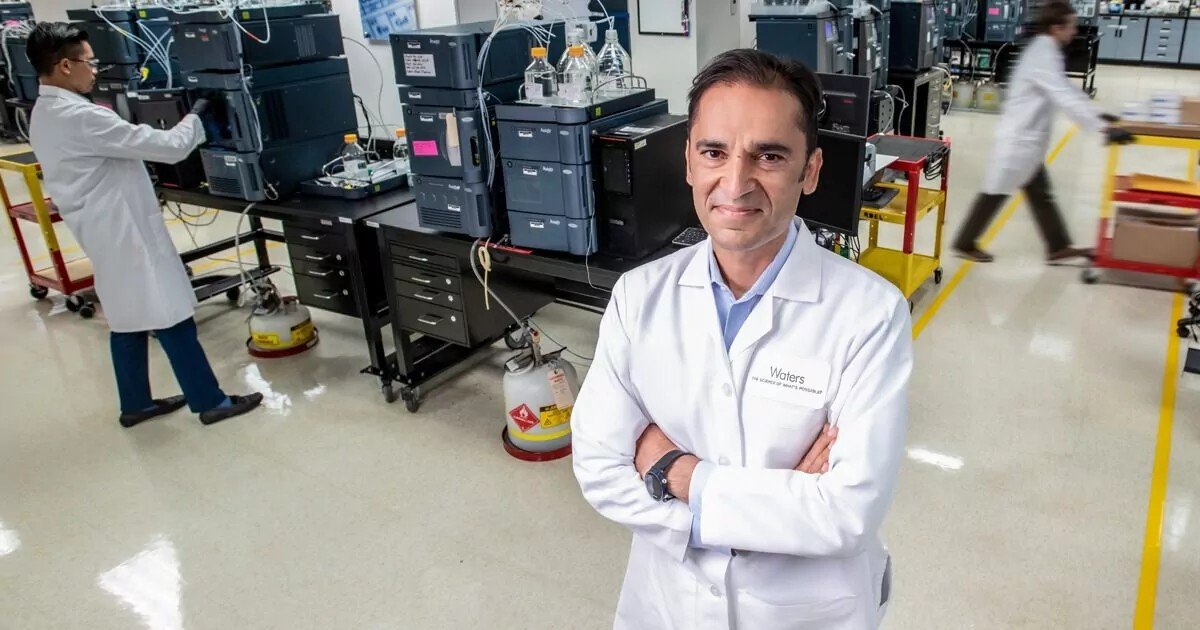

“Waters’ transformation, marked by strong commercial execution and revitalized innovation, positions us well for this exciting next chapter,” Udit Batra, PhD, Waters’ president and CEO, said in a statement. “We see tremendous opportunity to immediately apply our expertise in instrument replacement, service plan attachment, and eCommerce expansion, and realize the full potential of the flow cytometry and specialty diagnostics portfolios.”

Upon closing of the deal, expected next year, Batra will lead the combined company while Amol Chaubal, Waters’ CFO, will serve as SVP and CFO. Executives from both companies will be named to key leadership roles sometime in the future, the companies said. Up to two BD designees will join Waters’ board upon closing.

At $17.5 billion, the deal is the largest in life sciences so far this year, bumping to second Johnson & Johnson’s $14.6 billion purchase of Intra-Cellular Therapies, a deal announced during the 43rd Annual J.P. Morgan Healthcare Conference in January and completed in April.

Investors appeared less than enthused by the deal, with BD shares rising just 0.64%, from $175.90 to $177.09 at the close of trading Monday. Waters shares fell nearly 14%, from $353.04 to $304.18. However, Tycho Peterson, equity analyst with Jefferies, cautioned even before the start of trading that Waters’ stock price would drop based on investor concerns about the size of the deal and uncertainties that include:

- How much revenue will the combined company generate within its replacement cycle?

- How much increased demand will Waters-BD see for additional testing of PFAS (per- and polyfluoroalkyl substances) in its food/environment end-market?

“Significant credibility”

“Longer term, we like the merits of the deal, creating real scale, which has proven effective in the space, while also beefing up the TAM and keeping an attractive margin profile,” Peterson wrote in a research note. “Udit’s past track record should add significant credibility to the integration side, given that he was at Merck KGaA for the $17B Sigma-Aldrich deal that spawned the MilliporeSigma we know today.”

BD generated nearly $3.4 billion last year from its biosciences and diagnostics operations, which the company decided to sell or spin off in February in order to focus more closely on its core medical technology business.

Waters and BD expect the combined company to generate pro forma revenue of approximately $6.5 billion and roughly $2 billion in pro forma adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) this year. The combination is also expected to add to adjusted earnings per share (EPS) in the first year post-closing, as well as deliver pro forma mid-to-high single-digit revenue growth and mid-teens adjusted EPS growth annually between 2025 and 2030.

By 2030, the pro forma combined company is projected to have grown to approximately $9 billion in revenue, $3.3 billion in adjusted EBITDA, and an adjusted operating margin of 32%.

According to Waters and BD, the deal is expected to generate approximately $200 million of cost-cutting “synergies” by the third year after completion, and approximately $290 million of revenue synergies by year five.

Cost synergies are expected to come primarily through optimizing manufacturing, supply chain, and selling, general, and administrative (SG&A) costs, with the companies promising to maintain a strong commitment to R&D and commercial investments. Revenue synergies are expected to come from achieving commercial excellence, accelerating expansion into high-growth adjacencies, and realizing cross-selling opportunities.

The companies expect about $345 million of annual EBITDA synergies by 2030.

Reverse Morris Trust

The business combination will be structured as a Reverse Morris Trust, in which BD will spin off its Biosciences & Diagnostic Solutions business to its shareholders as a company that simultaneously merges with a wholly owned subsidiary of Waters. The deal structure holds the advantage of being generally free from U.S. federal income taxes for BD and its shareholders, who are expected to own approximately 39.2% of the combined company, with existing Waters shareholders holding the remaining 60.8%.

Waters was among companies cited by the Financial Times (FT) in April as potentially being interested in a Reverse Morris Trust, along with Qiagen and Revvity. At the time, the FT reported BD having entered sales talks with the two largest life-sci tools giants, Thermo Fisher Scientific and Danaher.

As part of the deal, BD will receive an approximately $4 billion cash distribution. BD has committed to using at least half of the cash proceeds to repurchase shares, with the rest to be used toward repaying debt, Tom Polen, chairman, CEO, and president, stated.

As a result, Waters is expected to assume about $4 billion of incremental debt, which would give the combined company a net-debt-to-adjusted EBITDA leverage ratio of 2.3x at closing.

The combination transaction is expected to close around the end of the first quarter of 2026, subject to regulatory approvals, Waters shareholder approval, and satisfaction of other customary closing conditions.

Upon closing, the combined company will continue to operate under the Waters name and retain its listing on the New York Stock Exchange under the ticker symbol WAT. Waters’ headquarters will remain in Milford, MA, while the combined company will maintain a “significant” presence in areas where BD Biosciences & Diagnostic Solutions now operates, according to the companies.

“We couldn’t be more confident that the combined company, under Udit’s leadership, represents the best path to create substantial value for shareholders,” Polen said. “Waters offers the right cultural fit for our Biosciences & Diagnostic Solutions associates to flourish and continue their legacy of developing new-to-world, innovative solutions that make a meaningful impact on global healthcare.”

The post $17.5B Deal Combines Waters with BD’s Biosciences and Diagnostics Business appeared first on GEN – Genetic Engineering and Biotechnology News.