Last year’s federal agency layoffs, grant discontinuations, and university funding cuts led to numerous warnings of the disastrous impact on U.S. science research. Gretchen Goldman, PhD, from the Union of Concerned Scientists, recently told Nature that the “beauty of academic research is that people could stick with hard problems for a long time to

make progress… We can’t create experts overnight.”

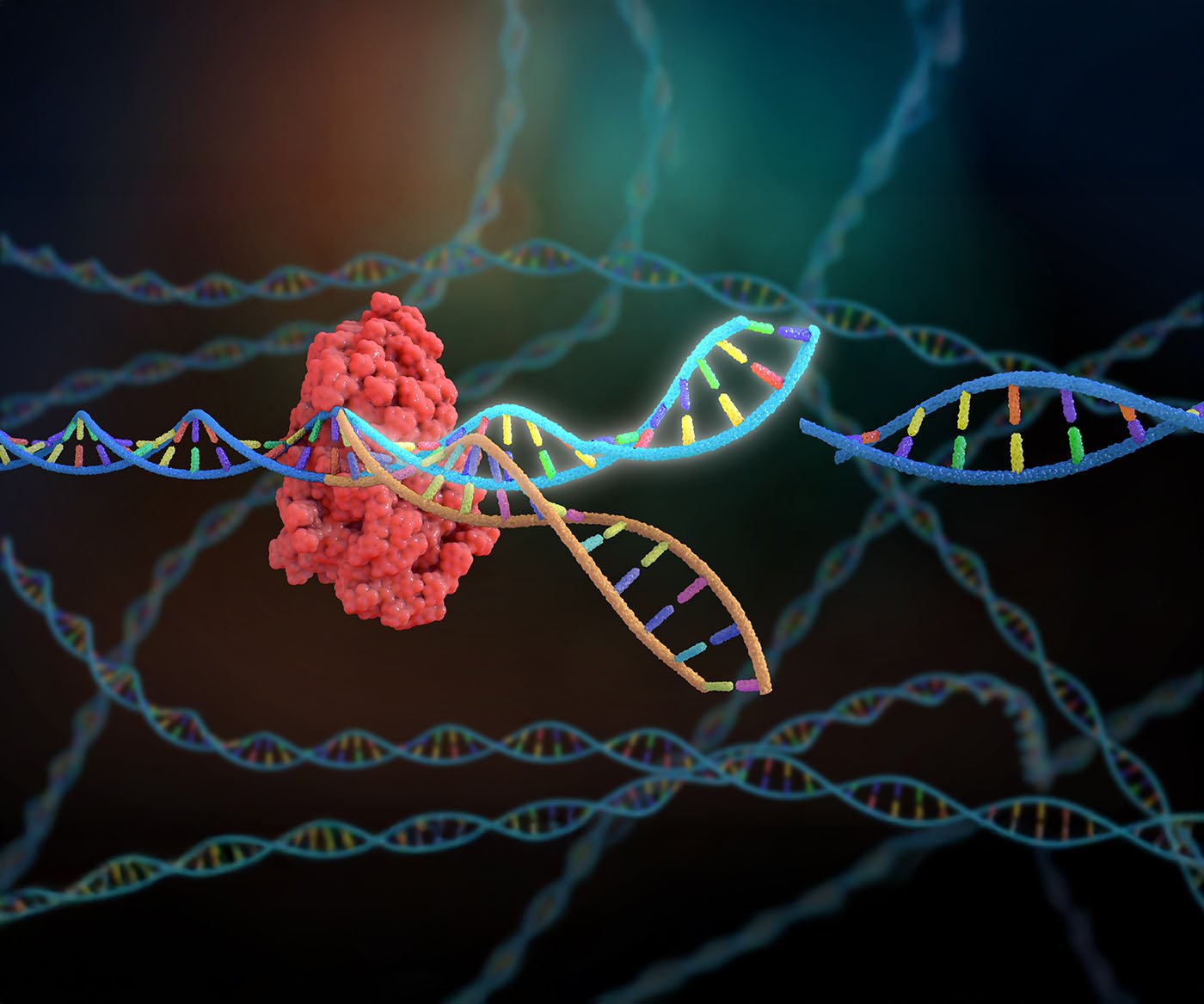

GEN wanted to know if CRISPR, one of the most promising biotechnologies—is undergoing a funding crisis. We asked three eminent experts in the field—Rodolphe Barrangou, PhD,

Jennifer Doudna, PhD, and Matthew Porteus, MD, PhD—for their thoughts on the topic.

Jennifer Doudna, PhD

Nobel Laureate in Chemistry; Professor, Li Ka Shing Chancellor’s Chair in Biomedical and Health Sciences at UC Berkeley; Innovative Genomics Institute Founder; HHMI Investigator

[Christopher Michel]

I would push back on the black-and-white “crisis/not a crisis” framing. Public biotech markets have been tough for a while, but CRISPR science has never been stronger. What some call a funding crisis is really a market recalibration. The early investment thesis treated CRISPR as a collection of one-off cures. What’s emerging is more sustainable—platform approaches that can address hundreds of diseases, not just one. Capital is flowing to where the platform model works: Eli Lilly acquired Verve for $1.3B to advance one-time treatments for cardiovascular disease—the world’s leading killer, and ARPA-H is making major investments in CRISPR infrastructure. The technology is not struggling, it’s that funding models are catching up to what’s now possible. This is exactly why philanthropic and government investment in foundational science matters—it bridges the gap between discovery and commercial viability, and it doesn’t follow stock prices.

Matthew Porteus, MD, PhD

Associate Professor of Pediatrics at Stanford School of Medicine; Scientific Founder of CRISPR Therapeutics; Co-founder and CSO of Kamau Therapeutics

While the initial investor excitement of CRISPR-based technologies (including base editing, prime editing, gene writing, gene knockouts and gene knock-ins) has subsided from its heady peaks of a few years ago, the potential transformative impact remains. And as clinical results provide long-term, perhaps even lifetime, beneficial changes in people’s lives from CRISPR-based drugs, those that have maintained their consistent support for the technology will be rewarded and that will re-attract those that pivoted in other directions. These first clinical results will also help outline how CRISPR can be best practically applied, and the giddy over-hype that CRISPR will be all things to everyone will recede to

a more reasonable scope that this powerful tool can be safely and effectively applied to.

In the exuberance about the CRISPR technology, there was an unrealistic expectation that the technology itself would circumvent the challenges of drug development and the business models that drive drug commercialization and distribution. Instead, CRISPR has revealed that innovations in both of these areas are also needed.

It will be exciting when CRISPR is integrated into the drug development toolbox alongside vaccines, small molecules, protein biologics, nucleic acid therapies to provide better and safer treatments for patients. And maybe AI/ML will even become part of that toolbox in the future as well.

Rodolphe Barrangou, PhD

Todd R. Klaenhammer Distinguished Professor, North Carolina State University; Co-founder of Intellia Therapeutics and Locus Biosciences; Co-founder, President & CEO of TreeCo; Co-founder, CSO of Ancilia Biosciences

I fundamentally disagree that CRISPR is suffering from a funding crisis. Biotech is in general, but this does not apply particularly to CRISPR. Several companies remain successful with fundraising and translational progress. Looking at the CRISPR start-up landscape overall, most have remained alive, on par for the course in terms of cycle(s) and across stages from the early rounds of publicly traded companies.

Early overvaluation has been an issue and remains so for a number of investors and shareholders. This has led to the culling of some incumbents that failed to execute or distinguish themselves from competitors via their choice of indications and/or technology platforms or failed to manage their burn rates. Failure for some of the companies in the ecosystem is standard and should be expected.

There is increased tech competition to invest in AI, synbio, and biomanufacturing. It is not just shining the spotlight on CRISPR but rather zeroing in on genome editing in context and relative to other investment opportunities.

A CRISPR world exists beyond therapeutics, and there are tangible investments that have been and are still being made in other areas, notably industrial biotech and agbiotech.

Looking at data and numbers (patents, investments, academic funding, clinical trials, INDs, publications, and Addgene dissemination), the data tells a strong story with maintained enthusiasm—somewhat surprisingly—albeit with varied success across the board when it comes to financial valuation, which is what investors focus on—as they should.

Overall, the perceived investment shortage is a regression to the mean, in my opinion. However, the data does not support this feeling—a lot of money has been invested by a number of entities into a number of start-ups, the majority of which are still alive and some even thriving. This is generally as expected for a rising and promising technology—a decade in, once enthusiasm abates and the real translational work has to materialize, only the strategically sound that create value survive.

I fear some of the most concerned opinions on CRISPR may come from disconnected academics or overly confident first-time entrepreneurs that may not appreciate the challenges inherent to commercializing disruptive technology, translating lab success into the clinic, or take into account the reality of investment and venture capitalist cyclicality.

The post CRISPR Roundup appeared first on GEN – Genetic Engineering and Biotechnology News.