A day after surpassing its own expectations with dazzling Phase III data for its lead pipeline candidate, the oral ulcerative colitis (UC) drug obefazimod, Abivax (Euronext Paris and NASDAQ: ABVX) so enthralled U.S. investors that it generated $3.1 billion in demand for a public offering of American depositary shares on Nasdaq that launched Wednesday at $650 million and grew Friday, generating nearly $100 million more in gross proceeds.

“We were about five times oversubscribed,” even after raising the size of the offering from an initial $400 million in response to investor demand, Abivax CEO Marc de Garidel, told GEN Edge. “We obviously need to confirm our findings with data from the maintenance trial, but there is no doubt this drug is special. It’s going to be a blockbuster.”

Paris-based Abivax priced its original offering of 10.156 million ADSs at $64 per share—a number that increased when underwriters fully exercised their option to purchase an additional 1,523,400 ADSs at the same price, raising the total offering value to $747.5 million. As a result, estimated net proceeds to Abivax grew from approximately $608.6 million to approximately $700.3 million, according to the offer prospectus.

According to that prospectus, Abivax plans to spend:

- Approximately $140 million to $185 million toward clinical development of obefazimod for UC.

- Approximately $30 million to $65 million toward clinical development of obefazimod for Crohn’s disease.

- The remainder for working capital and other general corporate purposes, “including preparation of commercialization, additional research and development, and financing expenses.”

Abivax began trading its ADSs in 2023 after completing a U.S. initial public offering (IPO) that raised about $212 million in net proceeds.

Historic week

The offering and its expansion capped an historic week for Abivax in which its ADSs and European shares rocketed into the stratosphere, leaping nearly six- and seven-fold in U.S. and European trading, respectively.

On Nasdaq, Abivax ADSs catapulted an eye-popping 586% Wednesday from $10 to $68.60, then rose nearly 2% Thursday to $69.36 before sliding nearly 5% to $66.49 on apparent profit taking. On Euronext Paris, shares soared 510% from €8.90 ($10.45) to €54.30 ($63.73) Wednesday, then advanced another 7% to €58.30 ($68.43) Thursday before dipping 2% to an even €57 ($66.90) on Friday. The prices of stocks and ADSs can differ for reasons that include currency exchange rates, market conventions, and potential differences in fees and taxes.

What impressed investors and analysts was data from a pair of Phase III induction trials showing improved symptoms in patients eight weeks after treatment with obefazimod. The data is strong enough to enable obefazimod to potentially disrupt the treatment of UC, whose current therapies are either sphingosine-1-phosphate (S1P) receptor modulators or Janus kinase (JAK) inhibitors.

At the drug’s highest dosage of 50 mg, a combined 636 patients from both trials showed a pooled 16.4% placebo-adjusted clinical remission rate—between the 19.3% rate of ABTECT-1 and the 13.4% rate of ABTECT-2.

Thomas J. Smith, a senior research analyst and a senior managing director covering the immunology and metabolism sector with Leerink Partners, and two colleagues wrote in a research note that obefazimod showed a better clinical remission rate than seven now-marketed drugs with UC indications:

- Etrasimod, marketed by Pfizer as Velsipity® (14.7%)

- Risankizumab, marketed by AbbVie as Skyrizi® (14.1%)

- Ozanimod, marketed by Bristol Myers Squibb (BMS) as Zeposia® (12.4%)

- Tofacitinib, marketed by Pfizer as Xeljanz® (11.7%)

- Vedolizumab, marketed by Takeda Pharmaceutical as Entyvio® (11.5%)

- Mirikizumab, marketed by Eli Lilly as Omvoh® (11.1%)

- Adalimumab, marketed by AbbVie as Humira® (8.7%)

Nearly half (47.3%) of patients in the combined two ABTECT trials had failed at least one prior advanced therapy, with 8% to 11% of patients having failed a prior JAK inhibitor—the largest population of patients with inadequate response to JAK inhibitor therapy, according to Abivax.

1,275 patients, 36 countries

ABTECT-1 (ABX464-105; NCT05507203) and ABTECT-2 (ABX464-106; NCT05507216) enrolled a combined 1,275 patients from more than 600 clinical trial sites in 36 countries. The multicenter, randomized, double-blind, placebo-controlled trials were designed to evaluate once-daily oral administration of obefazimod at 25 mg or 50 mg doses in adults with moderately to severely active UC. The first patient was dosed in October 2022.

The 25 mg once-daily dose of obefazimod achieved the FDA primary endpoint of clinical remission at Week 8 in ABTECT-1 with a placebo-adjusted remission rate of 21.4%. That rate was only 5.1% in ABTECT-2, thus missing the primary endpoint in that study. However, obefazimod 25 mg achieved a pooled placebo-adjusted clinical response rate of 28.6%, which according to Abivax indicates a strong signal for patients toward achieving clinical remission with extended treatment in the maintenance trial.

Does that suggest that the maintenance dosage could or should be 25 mg?

“We’ll know in less than a year’s time,” de Garidel replied. “In the maintenance trial, 25 mg may be a bit better, because it may reduce some of the headaches of patients, for example. But that needs to be proven.”

Abivax has reached full enrollment with 678 patients for its ABTECT maintenance trial (ABX464-107; NCT05535946), an ongoing study which is evaluating obefazimod’s safety and efficacy 44 weeks following treatment. “It’s actually 100 patients more than we thought we would recruit,” de Garidel said. Topline results are expected to be reported in the second quarter of 2026 from the maintenance study, which will continue to follow patients through 2030.

Should data from the maintenance trial prove positive, Abivax will pursue a New Drug Application (NDA) in the second half of next year, with the aim of launching obefazimod to market in the second half of 2027.

Additional positive data for obefazimod, de Garidel said, was the lower-than-expected placebo response rate, which was 4.4% for the pooled patient population of the ABTECT 8-week studies (2.5% in ABTECT-1, 6.3% in ABTECT-2). While Abivax expected a lower placebo response rate than 12.5% seen in an earlier Phase IIb study, the result exceeded expectations.

Lower placebo response rate

“We thought that it would definitely come down, but we were thinking more in the historical average, 7% to 8%. We divided that by half!” de Garidel said.

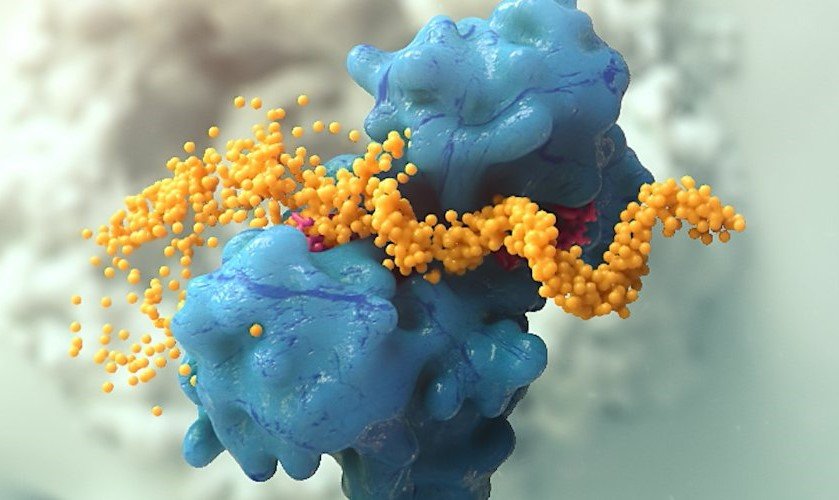

Obefazimod is a small molecule upregulator of miR-124, an anti-inflammatory microRNA. Obefazimod enhances the selective splicing of a single long noncoding RNA to generate miR-124, which downregulates cytokines and chemokines shown to promote inflammation, including tumor necrosis factor (TNF) alpha, IL-6, monocyte chemoattractant protein-1 (MCP-1) and IL-17, as well as Th17+ cells. Under its former name ABX464, obefazimod was initially developed against HIV but was repurposed to fight inflammatory conditions based on its anti-inflammatory effect.

“We believe best-case topline data from ABTECT have catapulted obefazimod to the forefront of the oral IBD landscape,” Smith observed. “Ultimately, we believe these results position obefazimod to address a key unmet need for an oral therapy that combines competitive rates of efficacy with a favorable safety profile and low monitoring burden.”

Smith cited the burdensome cardiac, dermatologic, and ophthalmic monitoring requirements associated with S1P modulators, as well as the boxed warning of one JAK inhibitor, AbbVie’s Rinvoq® (Upadacitinib), though Rinvoq generated a higher pooled clinical remission rate of ~25% in clinical studies.

“We further believe that the combination of strong 8wk induction results plus the breadth and quality of prior Phase [II] long-term extension data meaningfully de-risk the upcoming 44wk maintenance data readout expected in 2Q26,” Smith added.

Several of the marketed UC drugs constitute the oral IBD landscape, including Pfizer’s Velsipity and Xeljanz; BMS’ Zeposia, and AbbVie’s Rinvoq. According to Smith, those products all showed comparable clinical remission rates during Phase II and Phase III trials ranging from 10.3% (59-patient Phase III OCTAVE1 trial assessing Xeljanz) to 29% (515-patient Phase III U-ACCOMPLISH trial assessing Rinvoq).

$4B peak year sales forecast

Citing Abivax’s data, Smith maintained Abivax’s “Outperform” rating but boosted Leerink’s price target on Abivax shares nearly fourfold, from $20 to $74. He also raised Leerink’s peak year sales forecast for obefazimod 54%, from $2.6 billion to $4 billion.

Abivax won’t disclose its own sales projections for obefazimod, but the data it has presented to investors suggests a blockbuster in the making. The company projects that the U.S. market for UC drugs will grow 68% from $5.3 billion in 2023, according to Evaluate Pharma, to about $8.89 billion, representing a roughly 70% share of the $12.7 billion global UC drug market projected by 2030. The latter accounts for about half the $30.8 billion global market for inflammatory bowel disease treatments, a category that includes Crohn’s disease.

Obefazimod is also being developed for Crohn’s, where the drug is in the Phase IIb ENHANCE-CD trial (NCT06456593) that is now seeking to recruiting roughly 200 patients.

“We think that we will be reporting those results by the end of 2026,” de Garidel said. “It would take nearly 18 months to complete and to report the findings. We think that obviously the data that we just published will encourage doctors to participate in the study. And this is what actually our medical affairs team will do in the next few days and months—to make sure that doctors have a chance to test this Phase IIb drug, and then we’ll see how it goes, scientifically speaking.”

In addition to monotherapy, obefazimod is under study in combinations with other drugs. One of those is Velsipity, for which Abivax last year announced positive initial preclinical combination results in a mouse model of IBD. Those results, according to Abivax, showed the combination to improve the response on body weight protection and Disease Activity Index with a synergistic and statistically significant reduction of TNFa, IL-17, IL-6, IFNg in the blood compared to each drug alone.

Besides Smith, other analysts showed enthusiasm for Abivax stock. Morgan Stanley analyst Judah Frommer upgraded his firm’s rating from “Equalweight” to “Overweight” and multiplied its price target nearly sixfold, from $12 to $71.

Also multiplying their 12-month target prices:

- Citizens JPM Securities (Jason Butler)—Nearly triple (up 187%), from $33 to $95, maintaining “Market Outperform” rating.

- LifeSci Capital (Sam Slutsky)—More than double (124%), from $45 to $101, maintaining “Outperform” rating.

- Guggenheim (Yatin Suneja)—More than double (101%), from $50 to $101, maintaining “Buy” rating.

- Piper Sandler (Allison M. Bratzel)—Up 67%, from $42 to $70, maintaining “Overweight” rating.

Leaders and laggards

- Anebulo Pharmaceuticals (NASDAQ: ANEB) shares rocketed 82% from $1.83 to $3.33 Wednesday after the company’s board approved a reverse stock split ranging from 1-for-2,500 to 1-for-7,500 as part of a transaction to take the company private. The board will decide the exact ratio. Common stockholders will receive $3.50 cash per pre-split share in lieu of any fractional shares of post-split common stock. Shareholders owning less than a minimum number of shares (between 2,500 and 7,500) will not remain Anebulo stockholders after the reverse split. “Anebulo is taking these steps as it believes that the cost and expense of being a public reporting company has become too burdensome in light of the company’s strategy to develop its product candidates, continue to reduce its operating costs, and return the maximum value to its stockholders,” the company stated.

- Bavarian Nordic (NASDAQ Copenhagen: BAVA) shares climbed 21% Thursday, from DKK 192.50 ($30.28) to an even DKK 233 ($36.65) after the Danish vaccine developer confirmed it was in talks with a consortium of two potential acquirers: “We have been in discussions with Nordic Capital and Permira regarding a potential takeover offer,” Bavarian Nordic stated, saying it was responding to market rumors. The company’s marketed vaccines include Vimkunya

, indicated for prevention of chikungunya in people aged 12 and older, which won FDA approval in April. The United States and Canada accounted for almost 56% of Bavarian’s revenue in 2024, according to data compiled by Bloomberg News.

, indicated for prevention of chikungunya in people aged 12 and older, which won FDA approval in April. The United States and Canada accounted for almost 56% of Bavarian’s revenue in 2024, according to data compiled by Bloomberg News. - Replimune Group (NASDAQ: REPL) shares plunged 76% from $2.81 to $3.34 Tuesday after the company acknowledged that the FDA did not approve its Biologics License Application (BLA) for RP1 (vusolimogene oderparepvec) in combination with nivolumab to treat advanced melanoma. Instead, the agency issued a Complete Response Letter (CRL) indicating that Replimune’s IGNYTE trial (NCT03767348)—data from which supported the BLA—was not considered an adequate and well-controlled clinical investigation that provides substantial evidence of effectiveness. The FDA also said that the trial cannot be adequately interpreted due to the heterogeneity of the patient population studied. The CRL added that several items related to the design of a confirmatory trial needed to be addressed, including contribution of components. “The issues highlighted in the CRL were not raised by the agency during the mid- and late-cycle reviews. Additionally, we had also aligned on the design of the confirmatory study,” stated Replimmune CEO Sushil Patel, PhD.

- Sarepta Therapeutics (NASDAQ: SRPT) shares tumbled 15% this past week on developments that included stock downgrades by Needham and B of A Securities, a “Sell” rating at the start of coverage by Citi, plus news reports attributed to unnamed FDA officials stating the gene therapy Elevidys®, linked to two patient deaths this year, would have an “arduous” path toward returning to market (STAT News), and require additional testing before returning to market (Endpoints News). Shares dropped 5% from $14.08 to $13.32 Monday, bounced back 2% to $13.62 Tuesday, sank 2% to $13.32 Wednesday, declined another 3% to $12.88 Thursday, and slid a further 7% to $11.93 Friday after the European Medicines Agency’s Committee for Medicinal Products for Human Use recommended against approving Elevidys in Europe. Shares fell 4% to $11.47 in after-hours trading after the FDA said it was investigating the death of an 8-year-old Brazilian boy who received Elevidys; the company insisted the death did not result from the treatment, citing Brazilian authorities.

The post StockWatch: Abivax Shares Leap on Phase III Ulcerative Colitis Data, $747.5M Offering appeared first on GEN – Genetic Engineering and Biotechnology News.